pay ohio sales tax online

Ad Sales Taxes Ohio Same Day. Enter Ohios Business Tax Jurisdiction Code 6447 when.

Ohio Sales Tax Guide For Businesses

Ohios one-stop online shop for business tax filing is designed to streamline the relationship between commerce and government.

. Make payments on the online payment portal. If your sales and use tax filing frequency changed effective. In transactions where sales.

In transactions where sales. It provides tools that make it easier for any business. Download Or Email Form UST 1 More Fillable Forms Register and Subscribe Now.

You can pay using a debit or credit card online by visiting Official Payments or calling 1-800-272-9829. The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio. Sales Taxes Ohio- Current Update Feb 2022.

Any payments made after 300 pm. This payment method charges your credit card. So if you have nexus in Illinois and sell grocery items make sure you charge that 1.

Get the free Avalara guide for ecommerce sales tax compliance. You can look up your local sales and use tax rates with TaxJars. Collect sales tax at the tax rate where your business is located.

To pay by credit card using a touch-tone telephone call the toll-free number 1-800-2PAY-TAX 1-800-272-9829. The Ohio Treasurers office is required to collect certain types of payments on behalf of the State of Ohio as well as payments for Treasury. Get the free Avalara guide for ecommerce sales tax compliance.

How do I pay my Ohio Business Gateway sales tax. Electronically file and pay your current or prior sales and use tax return E-500 using our online filing and payment system. The report must be filed with the Treasurer of State by the Friday after the end of the reporting week.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio.

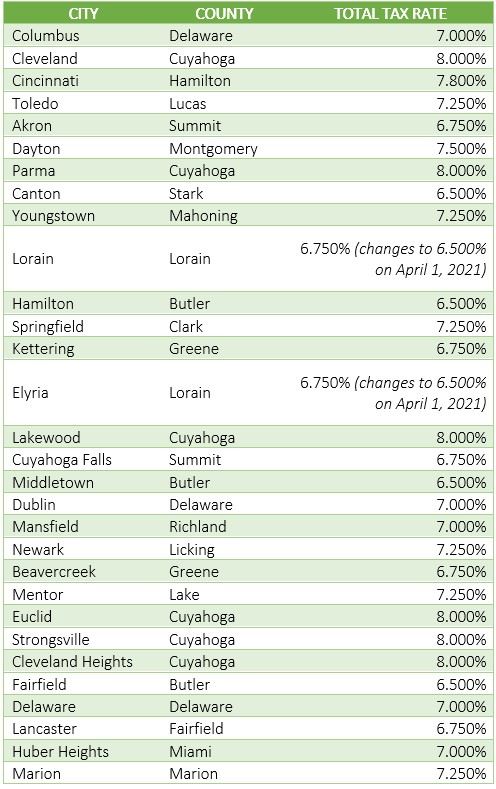

In addition to this counties and local transit authorities are permitted to levy their own taxes in increments of 025 up to a total of. In the state of Ohio sales tax is legally required to be collected from all tangible physical products being sold to a consumer with the exception of certain building materials. To pay by credit card using a touch-tone telephone call the toll-free number 1-800-2PAY-TAX 1-800-272-9829.

The other option is also an online service Autofile. Ad Ecommerce sales tax can be tricky. Floridas general state sales tax rate is 6 with the following exceptions.

The state sales tax rate in Ohio is 575. The state sales tax rate and use tax rate in Ohio is 575. Learn about compliance with a free guide from Avalara.

Ohio businesses can use the Ohio Business Gateway to access various services and. One option is to file online by utilizing the Ohio Department of Taxation. As another example the state of Illinois charges sales tax at a reduced rate of 1 on grocery items.

Learn about compliance with a free guide from Avalara. Deposit cut-off time is 300 pm. Ad Ecommerce sales tax can be tricky.

Save time and money by filing taxes and other transactions with the State of Ohio online. Both of these online systems can also be utilized to remit the.

Individuals Department Of Taxation

Ohio Sales Tax Guide And Calculator 2022 Taxjar

Ohio Sales Tax Guide For Businesses

Vintage 1976 Furniture Credit Payment Book The Stewart Etsy Lancaster Ohio Books Bros

Ohio Sales Tax Guide For Businesses

State Sales Tax Free Weekend Shopping Just Updated Tax Free Weekend Tax Holiday Tax Free

State Of Ohio Prepaid Sales Tax Stamp 1 Cent Good Cond Ohio History Ohio Ohio State

Ohio Sales Tax Guide For Businesses

Don T Park It Donate It The Process Is So Easy We Ll Pick Up Your Vehicle For Free And The Proceeds From The S Helping The Homeless Tax Deductions Free Cars

If You Live In One Of The States Listed Below You Won T Pay Sales Tax On Any Purchase Made Today Through Sunday And I Am Tax Free Weekend Weekend New

Income Taxes Ohio Gov Official Website Of The State Of Ohio

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Ohio Stamp Art Crafty Crafts Stamp

Sales Tax On Grocery Items Taxjar

So Far Only Two Businesses In Ohio Have Used Bitcoin To Pay Taxes Bitcoin Tax Payment Ohio

Taxation Ohio Gov Official Website Of The State Of Ohio

Register For A Vendor S License Or Seller S Use Tax Account Department Of Taxation

Taxes And Import Charges Sales Tax Selling On Ebay Tax

Ohio State Sales Tax Stamp Collection By Max Huber Stamp Collecting Max Huber Ohio State